The Merge’s impact on the NFT market cannot be disregarded. While once the most popular and most-affected NFTs are seeing a sudden surge in sales, other brand-new PoS tokens are minted in celebration of the occasion. Let’s zoom in on what’s happening in the post-merge market.

What did the Merge change in the NFT market?

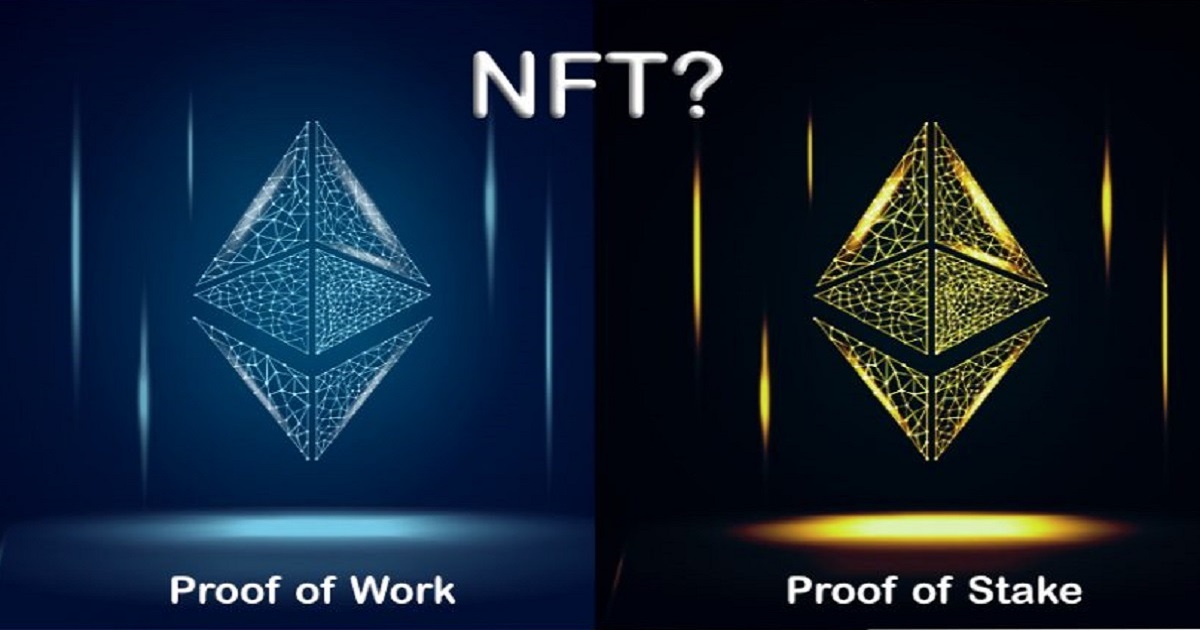

- Since Ethereum (ETH), the most popular blockchain for NFTs changed its consensus mechanism from a well-established Proof-of-Work (PoW) to a more energy-efficient Proof-of-Stake (PoS) on September 15 and completed the much-talked Merge, the overall NFT market is facing increased demand.

- The recent transition has both long-term and more immediate consequences on the NFT industry and across: among the first is the minimization of the blockchain’s ecological footprint by over 99%, while the latter includes a sudden surge in prices and sales of particular NFT items as well as NFT-selling marketplaces, such as OpenSea.

- The transition to PoS already reduced energy consumption twice, which means that minting, exchanging, and selling NFTs in an environmentally friendly mode is no longer a future but a tangible reality for each user. For comparison: before the merge, minting a new NFT item to a blockchain would require around 83kg of CO2, while each sale would produce 51 kg, according to the research conducted by NFT Club.

- The sale and price rates of NFTs are facing a post-merge boost, and new PoS collectibles are queuing to enter the market, as per the DappRadar report. Compared to last year’s not-so-encouraging statistics showing a decline of 675% in sales since August 2021, this is more than just a recovery for the global NFT market.

What was the first post-merge NFT?

- NFT enthusiasts did not lose their time once the merge was finalized. In less than an hour, the first-ever NFT on the PoS version of the Ethereum network was released. The collectible is tagged #Transition and belongs to a special panda face collection commemorating Ethereum’s transition to PoS, which is hosted on the OpenSea marketplace.

- To mint the first item, the user nicknamed @0xTransition had to spend 36 ETH in gas (which equals around $60,000), causing Twitter to explode with plentiful comments and jokes. The full collection now counts 100 items and is offered at a floor price of 0.6 ETH, with its most recent edition sold at an auction at over 4 ETH.

What was the first post-merge official NFT collection?

- Following the panda face example, hundreds of new NFTs began to flood the upgraded blockchain network. So began the race for the first-ever PoS Ethereum-based NFT collection.

- Web3 lifestyle brand Bloom turned up to come ahead of the rest by presenting its official brand NFT collection – the first to be minted on the PoS network, on which Sheldon Evans, the founder of the company proudly twittered.

- Consensys, a New-York City-based blockchain software company, joined the mass “green NFT” trend and minted its own commemorative NFT. In turn, an NFT artist Beeple added to the celebration by creating an illustration of a giant gradually evolving Ethereum logo on his Twitter.

What happened to some of the most popular NFTs?

- It is no exaggeration to say that the Ethereum Merge became somewhat of a renaissance to several of the once most popular and then most hard-hit NFT collections, such as Bored Ape Yacht Club and CryptoPunks.

- Bored Ape Yacht Club – a set of funky cartoon primates marked as “arguably the most successful NFT project“ and owned by stars like Madonna, Eminem, and Snoop Dogg, hit $1.3 million in sales on September 15 after a long decrease in price, according to DappRadar.

- Similarly, CryptoPunks – another long-standing NFT collection of 8bit-looking pixel humans founded in 2017 by the Larva Labs studio, faced a 56% increase in trading volume in the same period, thus reaching $1.4 million, as per the DappRadar report. One of the earliest Ethereum-based NFT projects ever, today it counts 10,000 unique characters, with the average price over $90.3k per item for the last seven days.

- Lastly, the Merge’s consequences benefited OpenSea, the world’s most successful NFT marketplace by all-time sales, which saw a 77% trading volume increase to $10 million as of September 15, having stabilized in the next few days.