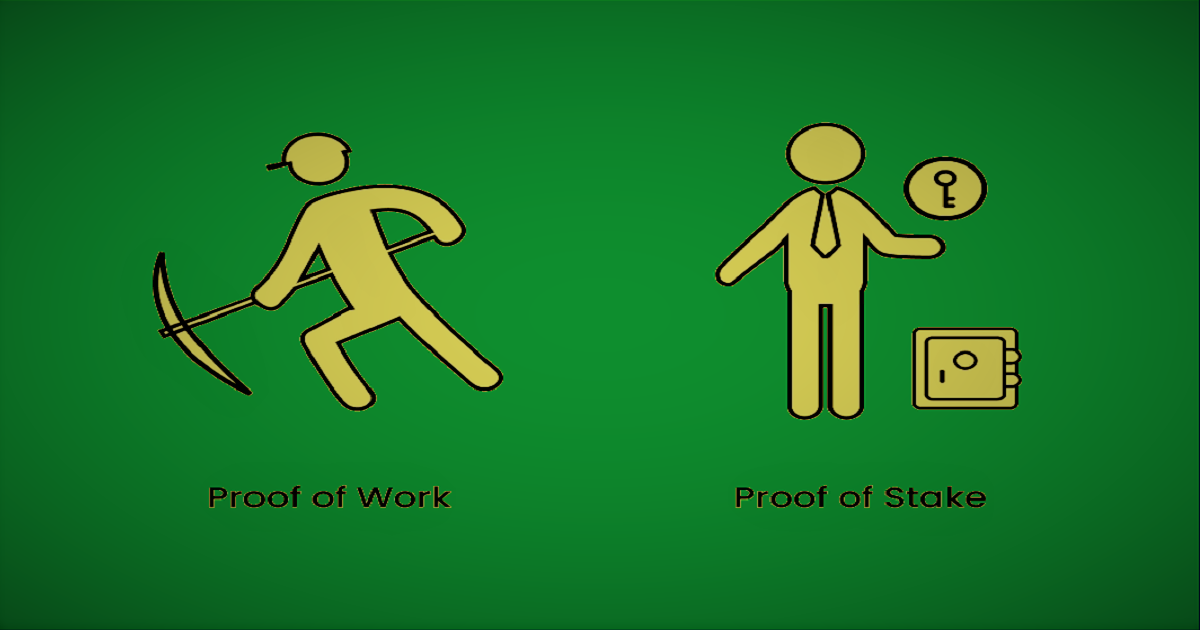

“Proof-of-Work” and “Proof-of-stake” are two core notions in the world of blockchain and cryptocurrency, but what do they mean practically and what is the difference between the two? – time to dot the i’s.

1

What is the Proof-of-Work in blockchain?

- Proof-of-work (PoW) represents the particular consensus mechanism that is used to help synchronize data, verify new information, forge new tokens and process transactions on the blockchain.

- Consensus mechanisms are combinations of specific protocols, rules, and incentives allowing a distributed set of nodes to negotiate the state of all data recorded on the blockchain and keep it secure.

- The Proof-of-Work algorithm requires computers to perform certain “work” – to do cryptographic calculations in order to validate and add the new blocks on the blockchain. This process is called mining, and the length of the chain and the number of blocks within it are defined by computer performance.

- This way in Proof-of-Work, the validator’s role is distributed among other computers within a particular blockchain network, which allows new blocks to be created and further transactions to be added upon approval. Every validated transaction on the blockchain receives hash/id – a unique fixed-length string of characters matching the encrypted requirements for computing on a blockchain. Through its encryption mechanism, it allows users to avoid malicious attacks and hacking attempts.

- PoW has been a core notion and a foundational technology in cryptocurrency since its beginnings: the concept itself was introduced by Moni Naor and Cynthia Dwork in 1993. It figured in bitcoin’s release papers in 2008 and was initially incorporated into the bitcoin blockchain when it was launched by Satoshi Nakamoto in 2009. PoW is thus an inseparable element in the process of bitcoin mining.

- In the PoW cryptocurrency network, a total given amount of computing power is referred to as hash rate and is typically measured in terahashes per second. The Hash rate in the PoW network indicates the security of such a network: the higher it is the more miners are involved in verifying transactions. It depends on a range of factors including speed, the number of computers (miners) performing work, and follows the market price of Bitcoin or other crypto involved. The PoW network allows miners to get revenue – their calculative efforts are rewarded with newly created cryptocurrency.

2

What are its (dis)advantages?

- A common criticism of the Proof-of-Work algorithm is associated with its considerable energy costs: huge amounts of energy output from using a computer’s GPU are mandatory to keep the network secure and decentralized.

- Although safety and decentralization are the characteristics inherent to the PoW mechanism and considered its apparent advantages, the algorithm is problematic in terms of the network scalability – the ability to scale and adjust it for future growth. This calls into question the idea of the mass adoption of cryptocurrency as a universal payment method.

- Besides, the competition between miners is typically tough, as the number of participants having control over the network is very high.

- Apart from that, mining with the PoW algorithm necessitates costly hardware – mostly single-purpose computers, thus questioning the accessibility of such a process.

3

Which cryptos use Proof-of-Work?

- The first and most well-known blockchain based on PoW is Bitcoin. Other popular blockchains using PoW are Bitcoin Cash, Litecoin, Monero, and the notorious Dogecoin.

- Ethereum blockchain was initially founded on the Proof-of-Work, yet shifted from a Proof-of-Work to a Proof-of-Stake consensus mechanism on Sept. 15, 2022, as a countermeasure to PoW’s electricity consumption and environmental footprint issues.

- Following that network shift, also known as the Merge, other Ethereum-based projects, such as Shiba Inu (SHIB) coin, had to change their consensus mechanism to Proof-of-Stake as well.

4

What is the Proof-of-Stake (PoS) and how does it work?

- Proof-of-Stake is a consensus mechanism that, unlike PoW, is not influenced by the computer’s GPU and calculative capacities, instead, it implies staking a particular amount of blockchain-native tokens in exchange for the validation of a new transaction.

- With PoS, anyone owning a specific amount of crypto can pledge to the network, activate their own validator, and earn transaction fees as rewards for their work. Though the validators are picked by a random algorithm, the weight of the particular vote in the PoS mechanism is defined by the size of the stake. So, the reward principle is simple: the more significant the amount of coins in the stake – the greater the chances of getting a bounty as the validator.

- This type of protocol was developed by Scott Nadal and Sunny King and proposed in 2011 as a faster and less resource-requiring alternative to Proof-of-Work. In the PoS blockchains, miners do not compete for the right to add blocks and are not limited to who can propose blocks based on energy usage, which results in having more nodes in the network.

- Recently, this consensus mechanism has gained further development in the form of the so-called Delegated Proof of Stake, in which owning a certain proportion of tokens equals a voting right, and users’ roles are distributed between validators and delegators. Validators are responsible for verifying new blocks, while delegators provide for the safety of the network, yet only a restricted number of participants are eventually eligible for getting rewards.

5

Is PoS better than PoW?

- PoS is deemed more advanced than PoW in offering greater potential for scalability and matchless sustainability. Due to less consumption of electricity, reduced centralization risks, and guaranteed security against 51% of various types of attacks, Proof of Stake gained more adoption in the last years.

- Other assets include speedier transactions, lower transaction fees in comparison with PoW, no need for special hardware, and thus, extended accessibility and more openness to everyone. All this explains the reasons why more new cryptos tend to employ the PoS mechanism and allows us to speculate that the upcoming generations of cryptocurrencies will also use it in the future.

6

What are its disadvantages?

- Though being attack-protected enough through community control, PoS, however, would lose to PoW in terms of network security, since the PoS mechanism requires fewer computers to take part in controlling the blockchain. Consequently, the cost of attacking PoS would be less than the time-proven PoW.

- Due to staking as its core mechanism, PoS has proven to have reduced centralization risk compared to PoW. Although having more nodes in the network indeed helps develop better resistance to centralization, the idea of PoS being totally decentralized can also be disputed. In particular, the PoS protocol cannot fully exclude the chance of dominance in the network by the holders of the biggest amounts of tokens, especially since buying a network stake requires a substantial investment upfront.

- Finally, the Proof-of-Stake protocol is newer, less battle-hardened, and does not own a performance track record, while being more complicated to implement (for instance, it took the Ethereum developers almost 7 years to build up and prepare the switch of this crypto to Proof-of-Stake).

7

Which cryptos use Proof-of-Stake?

- The first implementation of a proof-of-stake-based cryptocurrency happened in 2012 with the introduction of Peercoin, which was followed by several other cryptos including Blackcoin, Nxt, Cardano, and Algorand.

- Among other cryptos currently functioning on the PoS are the post-Merge Ethereum and a wide range of altcoins, such as Cardano, Solana, Polkadot, Tezos, Mina, and so on.

8

Are there other blockchain consensus mechanisms?

- Though not so widespread yet, there are several other consensus mechanisms on the blockchain, such as, for example, Proof-of-burn (PoB), which compels the users to destroy some portions of cryptocurrency in their possession to propose a new block and continue mining. The coins are unretrievable from the address they are sent to, yet this action helps prevent inflation of particular crypto, for example, stablecoins. Proof-of-burn requires minimal energy expenditures to verify transactions and at the same time balances the overall supply of crypto. Slimcoin (SLM), Factom (FCT), and Counterparty (XCP) are examples of cryptos based on this protocol.

- Another consensus mechanism gradually gaining popularity is Proof-of-Authority (PoA), which involves the disclosure of a miner’s real identity as a stake. By enabling a restricted number of blockchain actors to validate transactions and update its registry, this mechanism is generally deemed less decentralized, though provides faster transactions than PoW. Among the common platforms already using PoA are Xodex and VeChain.

- With the aforementioned types, the list of consensus mechanisms is far from being exhausted: there are newer protocols entering the market, such as Byzantine Fault Tolerance (BFT), Proof of Importance (PoI), Proof of Capacity (PoC), Proof of Elapsed Time (PoET), Proof of Activity (PoA), etc.